sales tax in tampa florida 2020

Tampa Florida 33602 813 274-8211. Florida Sales Tax on Concession Sales published August 27.

Best Mattress Stores In Tampa Fl With Costs Reviews

4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity.

. Average Sales Tax With Local. The Florida sales tax rate is currently. However most people will pay more than 55 because commercial rent is also subject to the local surtaxes at a rate where the building is located.

The 75 sales tax rate in Tampa consists of 6 Florida state sales tax and 15 Hillsborough County sales tax. Sales Tax Calculator Sales Tax. Rates include state county and city taxes.

The Tampa sales tax rate is. There are a total of 367 local tax jurisdictions across the state. Fort Myers Lehigh Acres Saint James City Bokeelia North Fort Myers Captiva and Pineland.

It is commonly known that tangible personal property is taxable in Florida. Automating sales tax compliance can. The 2018 United States Supreme Court decision in South Dakota v.

Ron DeSantis prepares to make deep cuts to the state budget for. The Florida Department of Revenue is responsible for publishing the latest Florida State. Floridas general state sales tax rate is 6 with the following exceptions.

Florida has a 6 statewide sales tax rate but also has 367 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 1037 on top of the state tax. The Hillsborough County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Hillsborough County local sales taxesThe local sales tax consists of a 100 county sales tax. As a matter of basic fairness its time for Florida to collect internet sales taxes that are owed but go unpaid.

The tax landscape has changed in the Tampa area. Did South Dakota v. The Florida state sales tax rate is currently.

This is a one-percent decrease from the 85 that had been in place since January 2019 previously the highest rate in the state of Florida. The peak of Floridas tourism season. So for example the sales tax rate in Hillsborough County will be 80 55 plus 25 local surtax while the tax in Orange.

Tangible personal property is defined as personal property that may be seen weighed measured touched or is in any manner perceptible to the senses. Total Discretionary Tax 7500. You can print a 75 sales tax table here.

The Florida state sales tax rate is 6 and the average FL sales tax after local surtaxes is 665. There is no applicable city tax or special tax. Use tax is due on the use or.

For tax rates in other cities see Florida sales taxes by city and county. Simplify Florida sales tax compliance. The state of Florida imposes a tax rate of 6 plus any local discretionary sales tax rate.

734 rows 2022 List of Florida Local Sales Tax Rates. What is the Florida sales tax rate for 2020. The latest sales tax rates for cities starting with T in Florida FL state.

Effective March 16 2021 businesses in Hillsborough County Florida are required to adjust the sales tax rate charged on goods and taxable services to 75. The Florida State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Florida State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. But a daily summary of money thats come in is 773 million below that.

This is the total of state county and city sales tax rates. Lowest sales tax 6 Highest sales tax 75 Florida Sales Tax. The Hillsborough County sales tax rate is.

The state estimated sales and use tax collections for March would total 31 billion. Total Sales Tax 60000. Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15.

If you need access to a database of all Florida local sales tax rates visit the sales tax data page. This table shows the total sales tax rates for all cities and towns in. TALLAHASSEE Floridas sales tax revenue fell 317 percent below projections in May state economists announced Friday as Gov.

Has impacted many state nexus laws and sales tax collection requirements. How to Calculate Hillsborough County Discretionary Tax. 2020 rates included for use while preparing your income tax deduction.

Groceries and prescription drugs are exempt from the Florida sales tax. Florida Restaurant Sales and Use Tax Audits published November 6 2020 by Paula Savchenko Esq. Ultimately you pay 28000 for the car saving 12000 off the original price.

The County sales tax rate is. Business LicenseTax Renewal PaymentsBusiness Tax Record InquiriesFederal Taxes Internal Revenue ServiceProperty Tax Payments Hillsborough CountyProperty Tax Records Hillsborough County. SB 126 championed by.

Groceries are exempt from the Hillsborough County and. What is the sales tax rate in Tampa Florida. The Hillsborough County Sales Tax is collected by the merchant on all qualifying sales made within Hillsborough County.

02262020 Key Services Aquatics. The state sales tax rate in Florida is 6000. This means that depending on your location within Florida the total tax you pay can be significantly higher than the 6 state sales tax.

How to Calculate Florida State Sales Tax. Counties and cities can charge an additional local sales tax of up to 15 for a maximum possible combined sales tax of 75. The December 2020 total local sales tax rate was 8500.

Florida has 993 special sales tax jurisdictions with local sales taxes in addition to the. What is Hillsborough County sales tax rate 2020. The current total local sales tax rate in Hillsborough County FL is 7500.

The minimum combined 2022 sales tax rate for Tampa Florida is. With local taxes the total sales tax rate is between 6000 and 7500. We provide for businesses who manage their own sales taxes and can also connect you with firms that can completely automate the sales.

Florida Sales Tax Audit Help published August 24 2020 by James Sutton CPA Esq. Wayfair Inc affect Florida. Florida has a 6 sales tax and Hillsborough County collects an additional 15 so the minimum sales tax rate in Hillsborough County is 75 not including any city or special district taxes.

Raised from 65 to 75. Tangelo Park FL Sales Tax Rate. Tampa FL Sales Tax Rate.

FL Sales Tax Rate. 72 rows On January 1 2020 the state tax rate was reduced from 57 o 55. To review the rules in Florida visit our state-by-state guide.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. In this scenario Florida will collect six percent sales tax on 31000 which is. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Growth Of Tampa Bay Tampa Hillsborough Expressway Authority

Local S Guide To Living In Tampa Bay 14 Things You Need To Know

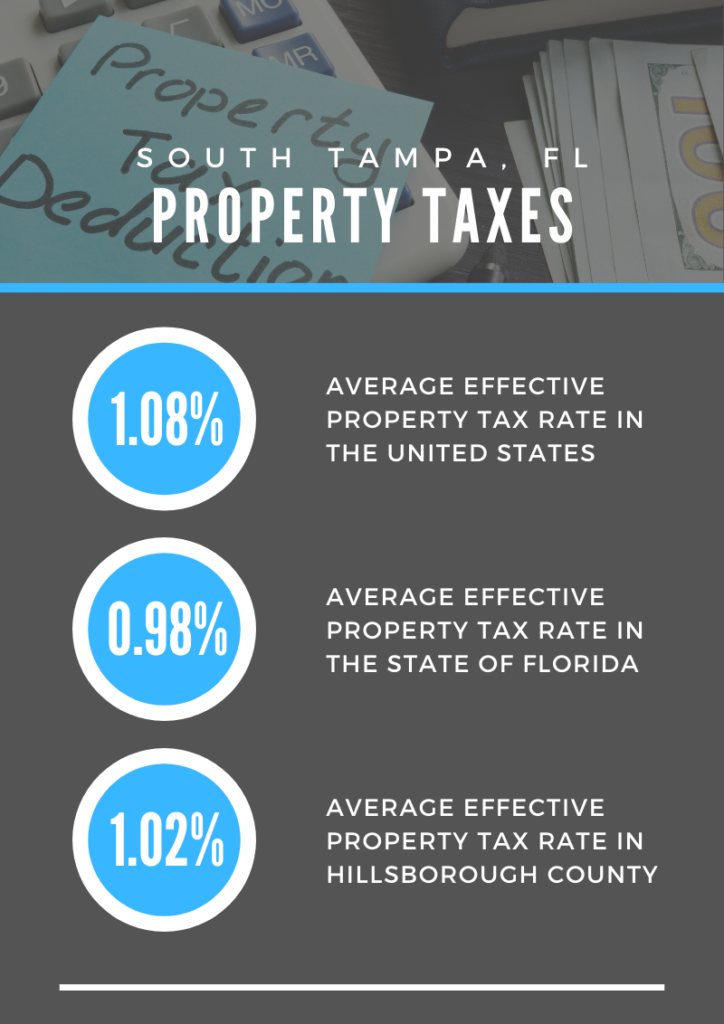

Property Taxes In South Tampa Fl Your South Tampa Home

The Tampa Real Estate Market Stats And Trends For 2022

Waterfront Tampa Florida Villa Boasts One Of The Largest Homesites In The City Mansion Global

64 Martinique Ave Tampa Fl 33606 Realtor Com

Thanks To Hillsborough County S Booming Local Tourism Industry The County Recently Became Eligible Under S Hotel Exterior Downtown Development Marriott Hotels

58 Martinique Ave Tampa Fl 33606 Realtor Com

12 Key Factors To Know About Living In Tampa Fl Homeia

12 Key Factors To Know About Living In Tampa Fl Homeia

12 Key Factors To Know About Living In Tampa Fl Homeia

Wages Lag Behind Tampa Bay S Rising Living Expenses Tampa Bay Business Journal

Moving To Tampa Here Are 13 Things To Know Extra Space Storage

Tampa Cost Of Living 2022 Can You Afford Tampa Fl Data

4918 Saint Croix Dr Tampa Fl 33629 Public Property Records Search Realtor Com Florida Style Homes House And Home Magazine Tampa Apartments

Moving To Tampa Here Are 13 Things To Know Extra Space Storage

8008 N 14th St Tampa Fl 33604 Realtor Com